Buyers

THE HOME BUYING PROCESS

While the home buying process can seem intimidating, once you know what to expect it is actually pretty simple. Knowing what to expect before you begin the process can lessen some of the anxiety associated with it for you and can also educate you should any issues come up during the process.

Because we want to help you be successful in your home search, we’ve written this step-by-step guide to the home-buying process. Follow these steps to enter your home search prepared and ready to make an offer on your dream home.

Step 1: Check your Credit

Before even contacting a lender or an agent, it is smart to check your credit report to see what your options are. You can get one free credit report a year, and this will determine what the interest rate on your mortgage will be, along with what kind of loans you can apply for. A good rule of thumb is that a good credit score is 720 or above, while the minimum to secure a loan through FHA is 580 or over.

Step 2: Decide on a Budget

It is important to find out how much you are willing to pay. Make sure to include mortgage payments into your budgeting, because even if you qualify for an expensive house you will probably not want that high a payment for the long term. Doing things like using a mortgage affordability calculator and researching the housing market so that you can think of a concrete number that will be affordable for you.

Step 3: Find an Agent

It is very important that you trust your agent because they will be your lifeline through the home buying process. Check reviews online or ask your friends and family for a referral, and make sure to ask a lot of questions and meet with a few candidates so you can find out your best fit.

Step 4: Get Pre-Approved

Getting pre-approved for a loan could make you more likely to get your offer accepted down the line. In pre-approval, a lender will pull your credit information and then give you a letter stating how much they would be willing to lend you. This gives the sellers some confidence in you because they know for sure that you will be able to afford their home.

Step 5: Start Looking at Homes

By now, since you’ve done all of your financial prep and talked to an agent, you probably have a pretty good idea of what kind of house you would like and in what area. Your agent can also help you greatly here, as they will have a good knowledge of properties coming on the market and homes like the ones you are looking for.

Step 6: Make an Offer

Once you’ve found a home that you are excited about, your agent will help you decide on an offer based on the listing price of the property. Your agent will understand how to craft your offer, based on the current market, whether there will need to be contingencies, or whether you need an inspection.

Step 7: Home Inspection

This is an important day for negotiating if your offer requires it. If the inspector finds any unseen defects, you can take them to the seller for bargaining power. Also, this is a good time to measure things in the house, because it is the last time you will be able to be inside before closing.

Step 8: Get Insurance and Utilities

If you have owned a home already, you will only have to call your insurance agent and let them know you’re buying a new home. But, if this is your first home, you will need to get homeowner’s insurance. Lenders require insurance, and it is a critical part of protecting your investment. You will also want to make sure you have utilities set up for your move-in date, because you will not want to arrive, ready to move in, only to find that you have no electricity.

Step 9: Close on Your Home

This is arguably the most important day in the process, and you will need your agent with you to help. At closing, you will read and sign all of the papers and policies that go along with officially owning your home, and you will want your agent there to make sure everything goes smoothly and that everything is how it should be for you.

Step 10: Move In!

You have officially reached the finish line by step 10! Your contract will specify the exact date that you can move in, and after that, you can officially make your new house into a home. Now that you’re settled in, let’s look at the benefits of owning a home.

BENEFITS OF OWNING A HOME

Buying a home can seem like a daunting task, particularly because it requires so much money upfront and you know that you will be paying for it for years to come.

It is one of the biggest financial decisions you will make in your life, so it requires careful consideration, but there are also a lot of upsides to owning your own home.

Some of these advantages include:

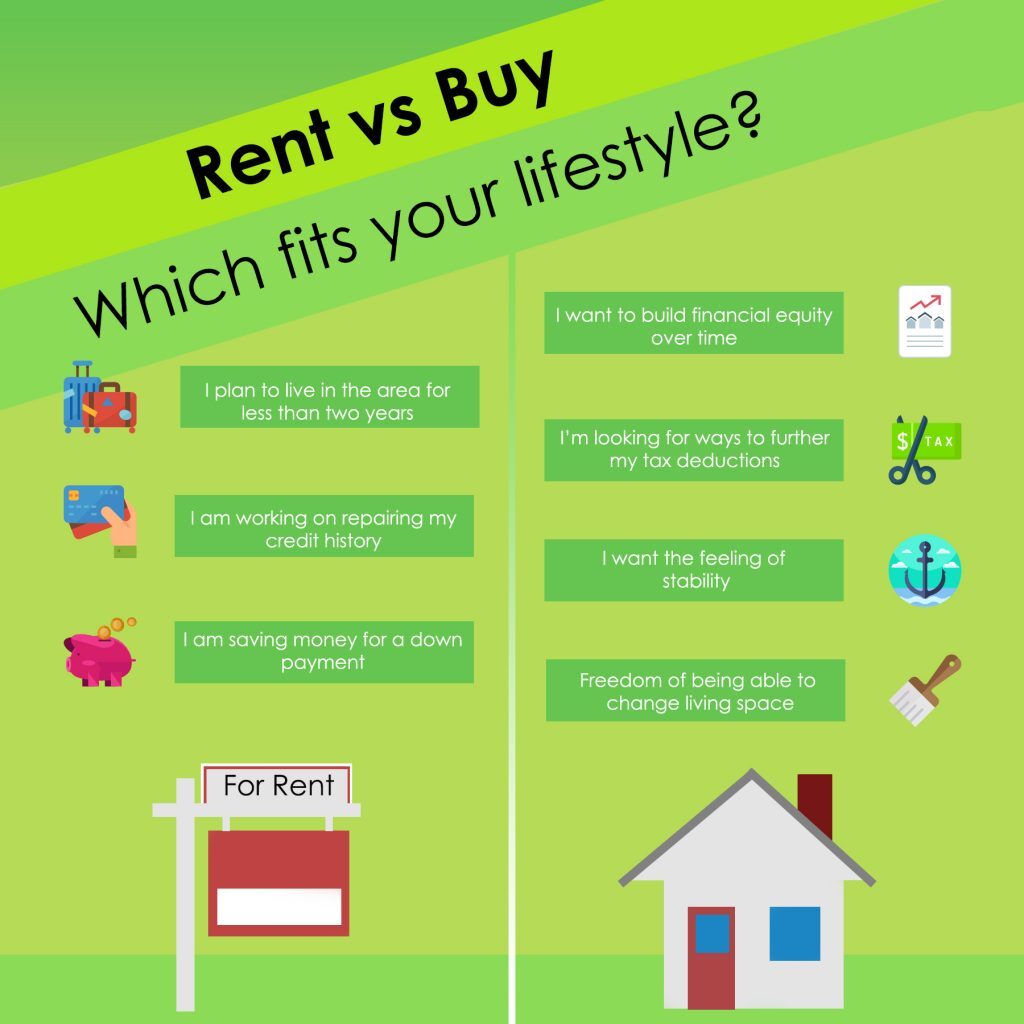

RENT VS BUY

There are definitely many different factors to consider if you are weighing buying versus renting. Homeownership requires you to have a stable or growing income, as you will be making payments for a very long time. While there are significant financial benefits, they are long-term so having a budget or savings plan in place before you purchase your home is critical. Also, your credit will affect your ability to buy a home more than it will your ability to rent, so knowing what your credit score is and how to improve it is another thing to consider.

Overall, there are many benefits to owning a home, especially if you think you will be in one place for a while and you feel financially stable. Here is a breakdown of the benefits of owning a home vs. renting a home.

sign into your property organizer

YOU CAN SIGN UP IF YOU DON'T ALREADY HAVE AN ACCOUNT!

Sorry we are experiencing system issues. Please try again.